Allocate a portion of your income toward savings before allocating funds to other expense categories.

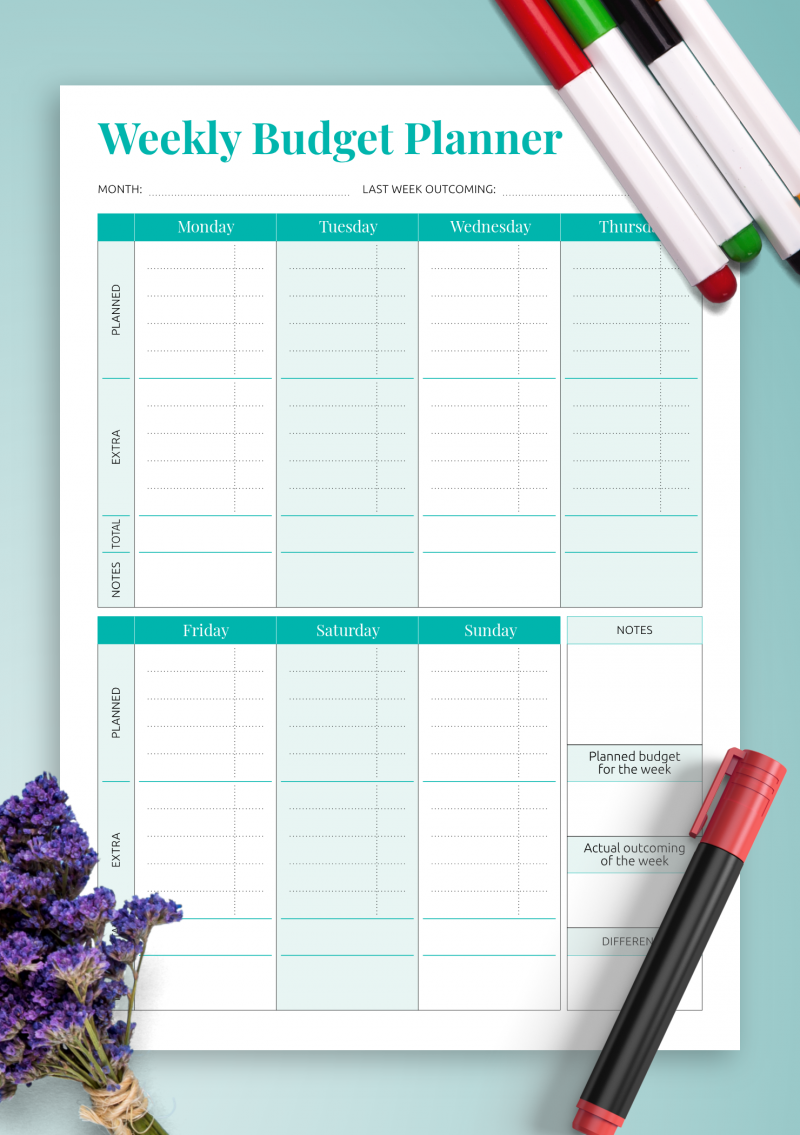

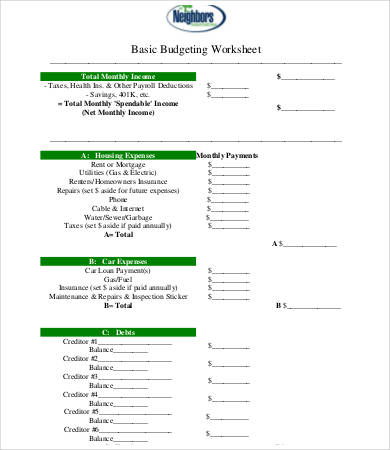

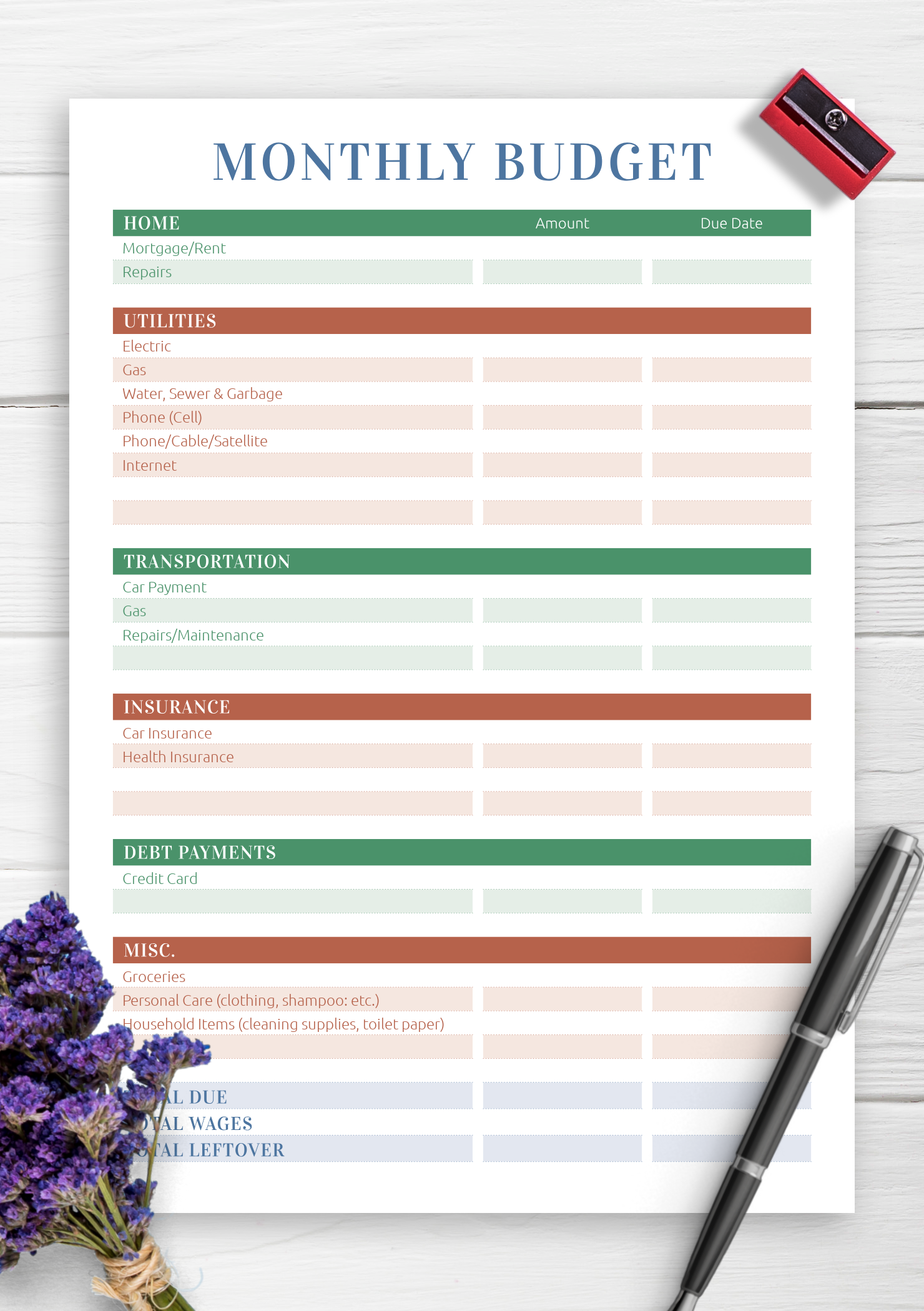

Identify areas where you can cut back or reallocate funds to align with your financial goals. Review your budget periodically and analyze your spending patterns. Incorporate these goals into your budget by allocating specific amounts toward each goal. Define your short- and long-term financial goals, such as saving for a vacation, paying off debt, or building an emergency fund. Regularly input your expenditures into the designated categories. Use the template to track your monthly expenses accurately. Ensure that your budget is realistic and aligns with your financial circumstances. Add, remove, or modify categories in the template to reflect your specific expenses.Ĭonsider your income, financial goals, and spending patterns when setting budget limits for each category. Common categories include housing, utilities, transportation, groceries, entertainment, debt payments, and savings.

PERSONAL BUDGET OUTLINES PDF

Modify the template to include these income streams, ensuring that you capture your complete financial picture.Įasily make adjustments to the template using a PDF editor or PDF converter tools from Adobe Acrobat online services.Īssess your spending habits and determine which expense categories are most relevant to your budgeting needs. Identify all your income sources, including salaries, freelance work, side hustles, investments, or rental income.

These tools can streamline the process by categorizing transactions and generating spending reports.

PERSONAL BUDGET OUTLINES SOFTWARE

You can also consider using budgeting software or mobile apps that can automatically sync with your bank accounts and credit cards to track your expenses. Look for templates that are compatible with Excel or PDF formats. Select a template that aligns with your budgeting goals and the level of detail you require. Having a structured budgeting system helps you prioritize your spending and make adjustments as needed, ensuring that your money is working toward your desired outcomes. It serves as a constant reminder to stay on track with your financial goals, whether it’s saving for a down payment on a house, paying off debt, or planning for retirement. A budget template encourages discipline and accountability. By visualizing your income and expenses in an organized manner, you gain valuable insights into your spending patterns and can make informed decisions about where to allocate your resources. A budget template allows you to track your income sources, such as salaries, freelance work, or passive income streams, and categorize your expenses into various categories, like housing, transportation, groceries, entertainment, and more. Instead, you can leverage the pre-built structure and modify it according to your specific needs. With a template, you don’t have to start from scratch or spend hours creating a budgeting system. One of the top advantages of using a budget template is that it simplifies the process of budgeting, especially for those who may find the task daunting or time-consuming. Here are some of the primary benefits that come with using a budget template:

Think of it as a roadmap for your finances, outlining where your money is coming from and where it is going. It serves as a guide, providing structure and categories to track your income, expenses, savings, and investments. What is a budget template, and 3 reasons you need one.Ī budget template is a pre-designed framework that helps you organize and manage your financial information in a systematic manner.

0 kommentar(er)

0 kommentar(er)